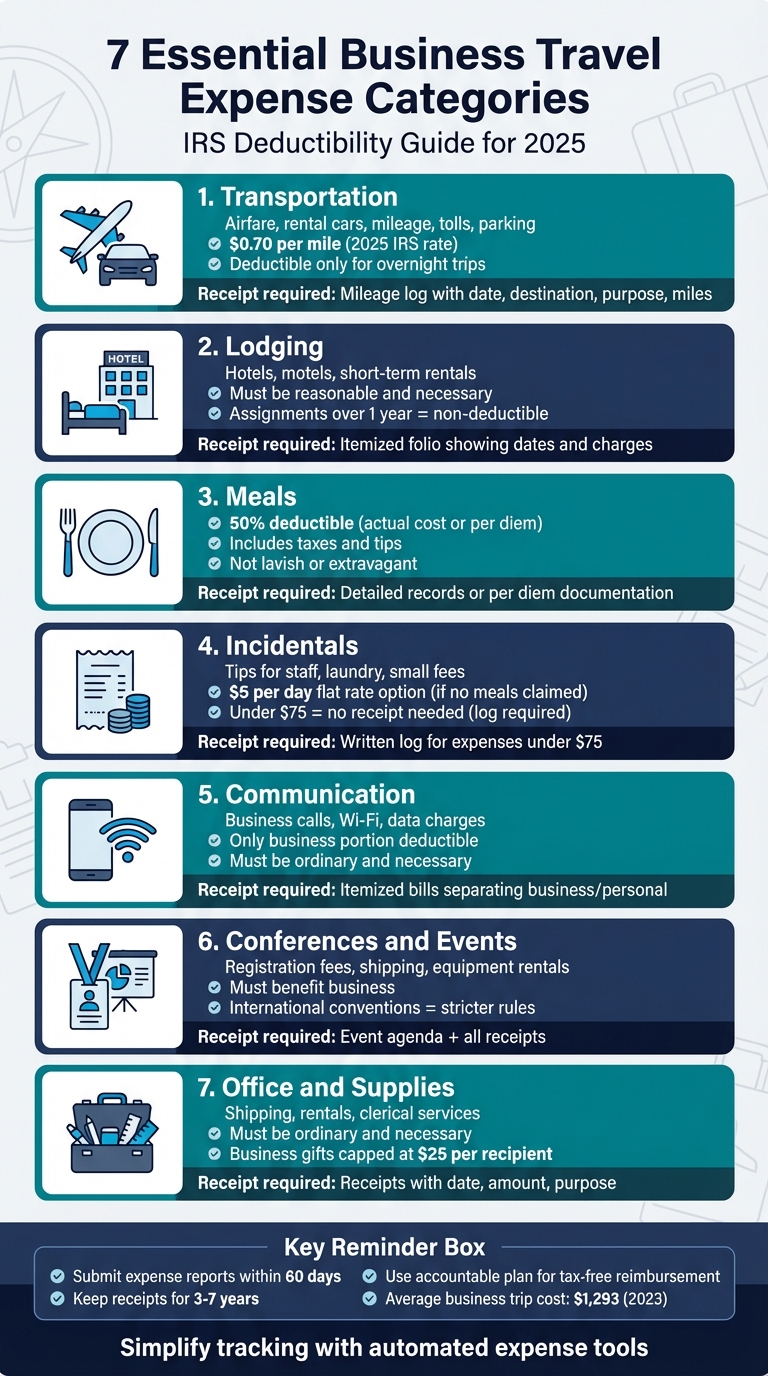

Top 7 Expense Categories for Business Travel Reports

Business travel expenses can be a headache if not categorized properly. They rank as one of the biggest controllable costs for small-to-medium businesses, and poor reporting can lead to missed tax deductions, delayed reimbursements, and compliance issues with IRS rules.

To simplify the process and ensure compliance, here are the seven key expense categories every business traveler should know:

- Transportation: Includes airfare, rental cars, mileage ($0.70 per mile in 2025), tolls, and parking. Deductible only for trips requiring an overnight stay.

- Lodging: Covers hotels and short-term rentals. Must be reasonable and documented with itemized receipts.

- Meals: Deductible at 50% (actual cost or per diem). Requires detailed tracking, especially for tips and taxes.

- Incidentals: Includes tips for hotel staff, laundry, and small fees. Expenses under $75 don’t need receipts but must be logged.

- Communication: Business-related phone calls, Wi-Fi, and data charges. Only the business portion of shared services is deductible.

- Conferences and Events: Includes registration fees, shipping materials, and equipment rentals. Must directly benefit your business.

- Office and Supplies: Covers shipping, rentals, and clerical services used during travel. Personal expenses aren’t deductible.

Quick Tip:

Use tools like EasyTripExpenses to track receipts, categorize costs, and simplify reporting. Proper documentation ensures tax-free reimbursements and avoids IRS penalties.

Each category has its own IRS rules for deductibility and documentation, so staying organized is key. Accurate categorization not only helps with compliance but also speeds up approvals and keeps your finances in check.

7 Essential Business Travel Expense Categories and IRS Deductibility Rules

1. Transportation

Relevance to Business Travel

Transportation expenses include a wide range of costs such as airfare, train and bus tickets, local transit (like taxis and rideshares), and vehicle-related expenses. These vehicle costs can cover personal, rental, or company cars, as well as tolls, parking fees, and shipment charges.

One critical rule to keep in mind: transportation expenses are typically deductible only when the trip qualifies as "traveling away from home." In tax terms, this means you must be away from your main place of business (your tax home) for longer than a normal workday, often requiring an overnight stay. However, regular commuting between your home and your usual workplace doesn’t meet the criteria for deductions.

IRS Deductibility Guidelines

For 2025, the IRS standard mileage rate is set at $0.70 per mile. You can either use this rate or calculate actual vehicle expenses. Regardless of the method, tolls and parking fees remain deductible.

Some important limitations apply: if an assignment lasts over a year, related transportation expenses become nondeductible. Additionally, frequent flyer miles are considered to have no monetary value for tax purposes. For rental cars, only the portion used for business qualifies for deductions.

Documentation Requirements

To ensure compliance, keep a detailed mileage log that records the date, destination, purpose, and miles driven. Update your log regularly, include yearly odometer readings, and save receipts for any actual expenses. Records should be retained for three to seven years, and digital GPS logs are an acceptable alternative to handwritten logs.

Common Corporate Policies

Many businesses establish clear-cut policies to separate business travel from personal commuting. These policies often rely on point-to-point distance calculations, which help exclude personal detours and regular commutes from reimbursable mileage. Employees are typically encouraged to keep personal copies of their mileage logs for added security.

Reimbursements are usually handled in one of two ways: either based on the IRS standard mileage rate or through actual expense reimbursement, depending on company policy. Some businesses also adopt combined fixed and variable rate plans to manage costs effectively.

Next, we’ll dive into lodging expenses, another key aspect of business travel reporting.

2. Lodging

Relevance to Business Travel

Lodging expenses cover stays at hotels, motels, short-term rentals, and related costs like tips for hotel staff, porters, or baggage carriers. To be tax-deductible, these expenses must be considered ordinary, necessary, and appropriate for your specific business needs. However, lodging at your tax home is not deductible, even if you maintain a separate family residence. For assignments lasting less than a year, lodging costs are deductible; once the assignment exceeds a year, these expenses are no longer eligible.

IRS Deductibility Guidelines

The IRS emphasizes that lodging expenses must be reasonable and not extravagant. While there’s no strict dollar limit, the costs should align with the business purpose and the local pricing norms.

"You can't deduct expenses that are lavish or extravagant, or that are for personal purposes." – IRS

If you're not claiming meal expenses, you can still deduct $5 per day to cover incidental costs like hotel tips. To help gauge reasonable expenses, the U.S. General Services Administration (GSA) provides federal per diem rates, which serve as a widely used guideline.

Documentation Requirements

The IRS requires detailed documentation for lodging expenses, regardless of the amount. Your receipt should include:

- Hotel name and location

- Dates of your stay

- An itemized breakdown of charges (e.g., separating lodging, meals, and additional fees like phone calls)

To avoid issues, ask for an itemized folio at checkout. It’s also important to report lodging and meal expenses separately, as meal costs are subject to a 50% deduction limit. Keep these records for the timeframe recommended by IRS guidelines. If your trip combines business and personal days, only the lodging costs directly tied to business activities are deductible.

Common Corporate Policies

Many companies base their lodging reimbursement limits on GSA per diem rates, which vary by location. About 85% of U.S. counties follow the standard per diem rate, while roughly 300 "Non-Standard Areas" have higher rates due to local cost differences.

Corporate policies often prohibit reallocating unused meal allowances to cover lodging costs that exceed the limit. However, many include an actual expense provision, allowing reimbursement up to 300% of the standard rate if no suitable lodging is available - provided prior approval is obtained. Lodging taxes are typically reimbursed separately from the room rate.

| Policy Element | Common Corporate Standard |

|---|---|

| Limit Basis | GSA Per Diem Rates (location-specific) |

| Receipt Requirement | Mandatory for all lodging expenses |

| Taxes | Reimbursed separately from the room rate |

| Over-limit Cap | Up to 300% of per diem with prior approval |

Next, we’ll dive into meal expenses, another critical part of travel reporting.

3. Meals

Relevance to Business Travel

Meal expenses are a standard part of business travel. For these costs to be reimbursable, they must meet the IRS criteria of being "ordinary and necessary." In other words, the expenses should be typical for your industry and relevant to conducting business. These expenses are only eligible during overnight or extended trips. For example, grabbing a quick lunch near the office wouldn’t qualify, but meals during an overnight business trip would.

The IRS also stipulates that the taxpayer (or an employee) must be present when the meal is provided, and the expense must not be considered lavish or extravagant based on the circumstances. These rules form the basis for understanding IRS limitations and required documentation.

IRS Deductibility Guidelines

Meal expenses are generally deductible at 50% of the unreimbursed cost. This rule applies whether you choose the Actual Cost Method or the Standard Meal Allowance (Per Diem) method. The temporary 100% deduction for restaurant meals, which applied during 2021–2022, has now expired, returning the limit to 50%.

"An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your business." – IRS Publication 463

Meal costs can include taxes and tips, but transportation costs to and from the restaurant should be recorded separately as a transportation expense. Additionally, if meals are part of an entertainment event, the food and beverages must be billed separately, as entertainment expenses are generally non-deductible.

Documentation Requirements

You can document meal expenses using one of two approaches: the Actual Cost Method or the Standard Meal Allowance (Per Diem).

| Feature | Actual Cost Method | Standard Meal Allowance (Per Diem) |

|---|---|---|

| Recordkeeping | Keep receipts and detailed records | Receipts not required; record time, place, and purpose |

| Calculation | Based on the actual amount spent (including tax and tip) | Based on federal per diem rates that vary by location |

| Deductibility | Generally limited to 50% | Generally limited to 50% |

| Best For | High-cost areas where actual spend exceeds per diem rates | Simplifying reporting and reducing paperwork |

If you opt for the per diem method, you’ll need to check the U.S. General Services Administration (GSA) website for the latest rates, which vary by location. Note that the per diem rate is usually prorated to 75% on the first and last days of travel.

Common Corporate Policies

Many companies set meal allowances based on GSA per diem rates or develop their own guidelines tailored to specific locations and trip durations. Under an accountable plan, employees do not need to report these reimbursements as taxable income, provided they fully document their expenses and return any excess funds.

In most cases, the standard meal allowance also includes incidental costs, like tips for porters or hotel staff. Corporate policies typically require meal expenses to be reported separately from other travel costs, as they are subject to different IRS deduction limits.

4. Incidentals

Relevance to Business Travel

Incidental expenses are those smaller costs that often accompany your primary travel expenses. According to the IRS, these include fees and tips given to porters, baggage carriers, hotel staff, and ship crew members. Other examples might be laundry and dry cleaning during overnight trips, ATM withdrawal fees, charges for using business centers, or purchasing small office supplies while traveling.

Though these expenses may seem minor individually, they can quickly add up. For instance, on a typical business trip, you might spend $3 per bag for porters, $4 per night for housekeeping, and small fees for ATM withdrawals - potentially totaling $50 or more over just a few days. The IRS requires incidental expenses to be both "ordinary and necessary", meaning they should be typical for your industry and relevant to conducting business. While these costs are small, they are subject to strict IRS rules, which we’ll cover next.

IRS Deductibility Guidelines

Just like other travel-related costs, documenting incidental expenses properly is essential for compliance and accurate reimbursements. These expenses are fully deductible if they meet IRS standards. However, since the 2018 tax reform, employees can no longer claim unreimbursed business expenses on their personal tax returns. Instead, they must request reimbursement through their employer’s accountable plan. On the other hand, self-employed individuals and business owners can still deduct these expenses on Schedule C (Form 1040).

For simplicity, the IRS provides an "incidental-expenses-only" option, which allows travelers to claim a flat rate of $5 per day for U.S. travel if they don’t incur meal expenses but do have incidental costs. This option eliminates the need for individual receipts. Generally, the IRS doesn’t require receipts for expenses under $75, except for lodging. However, travelers should still keep a detailed log noting the date, amount, place, and business purpose - especially for cash tips where receipts aren’t available.

Documentation Requirements

For incidental expenses under $75, the IRS allows a written log as sufficient documentation. This is especially useful for cash transactions like tips, where receipts are uncommon. Your log should include the date, amount, location, and business purpose, recorded as close as possible to the time of the expense. For expenses over $75, you’ll need to provide receipts or digital records of the transaction.

To streamline the process, many companies rely on digital tools to capture receipts and log expenses in real time, ensuring documentation is complete. Bank statements can also be used to verify charges like ATM and foreign transaction fees.

Clear documentation not only ensures compliance but also helps companies enforce policies to manage these smaller costs effectively.

Common Corporate Policies

Although the IRS sets a $75 threshold for requiring receipts, many companies adopt stricter rules, such as requiring receipts for all expenses or setting lower limits like $25. Some organizations simplify things by using GSA per diem rates, which combine meals and incidental expenses into a single allowance, eliminating the need for tracking small costs individually.

Corporate policies often outline maximum allowable tip percentages and specify prohibited expenses, such as in-room movies or personal grooming services, to maintain consistency across the company. To further reduce incidental costs, businesses may encourage using corporate cards that waive foreign transaction fees, particularly for international trips.

5. Communication

Relevance to Business Travel

Communication costs play a key role in keeping professionals connected with clients, colleagues, and their offices while on the road. The IRS considers expenses like business calls, fax transmissions, and other forms of communication as legitimate travel-related costs. This includes phone calls, faxes, emails, and conference calls. Additionally, fees for renting computers or hiring public stenographers for business purposes during travel also fall under this category.

In today’s world, staying connected often means covering expenses for international calls, data usage, and Wi-Fi access. While IRS guidelines were written before smartphones became a staple, the term "other communication devices" is understood to include modern digital tools.

IRS Deductibility Guidelines

To qualify for deductions, communication expenses must meet the IRS's criteria of being both ordinary and necessary. This means the costs should be directly related to business activities while traveling away from your tax home for more than a regular workday.

Personal communications, however, are not deductible. If a communication service is used for both personal and business purposes, only the business-related portion can be claimed. Additionally, the IRS disallows deductions for expenses deemed extravagant, even if they are tied to business activities.

Documentation Requirements

The IRS mandates detailed records for communication expenses. This includes keeping receipts, bills, or canceled checks that show the amount, date, and vendor, along with notes on the business purpose of each charge (e.g., "Call to XYZ Corp about Q3 project").

It’s a good habit to log expenses immediately, noting the date, amount, vendor, and reason for the charge. While bank or credit card statements can confirm amounts, they don’t clarify the business purpose, so additional documentation is crucial. Accurate tracking and categorization of communication costs ensure compliance and simplify reporting.

Common Corporate Policies

Many companies establish clear policies to manage communication expenses. For instance, employees may be required to submit itemized statements that separate personal and business charges. By having well-defined internal guidelines and thorough documentation, businesses can ensure only valid, business-related communication costs are reimbursed and deducted.

Next, we’ll examine other expense categories that contribute to well-rounded travel reporting.

sbb-itb-386cb5b

6. Conferences and Events

Relevance to Business Travel

When it comes to business travel, conference and event expenses are another area that requires careful tracking and reporting. These expenses typically include registration fees, shipping costs for display materials or samples, equipment rentals (like computers or stenographer services), and even tips associated with these activities.

IRS Deductibility Guidelines

According to the IRS, conference-related expenses are deductible if they are considered "ordinary and necessary" for your business.

"Travel expenses for conventions are deductible if you can show that your attendance benefits your trade or business." – IRS

However, international conventions held outside North America are subject to stricter scrutiny. They must meet a reasonableness test to qualify for deductions. Additionally, business meals during these events are generally capped at a 50% deduction, while registration fees are usually fully deductible.

Documentation Requirements

To substantiate your claims, keep the event agenda or program as proof that the conference was relevant to your business. This material demonstrates how specific sessions or activities contributed to your professional development. Record all expenses with details such as the date, amount, vendor, and purpose, and keep every receipt or related document. For trips that mix business with personal activities, make sure to clearly separate the business-related costs from personal ones.

Common Corporate Policies

Many companies require employees to follow accountable plan guidelines, which often include submitting the conference agenda along with expense reports. This ensures that all expenses are tied directly to business activities and meet company standards for reimbursement.

7. Office and Supplies

Relevance to Business Travel

Office and supply expenses play a crucial role in maintaining productivity during business trips. These can include costs like shipping, equipment rentals, and clerical services. The key is that these expenses must directly support your business activities while you're on the road. Essentially, they complement other travel-related expenses, such as transportation and lodging, by ensuring your work runs smoothly.

IRS Deductibility Guidelines

The IRS lays out clear standards in Publication 463:

"An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your business."

To qualify as deductible, your expenses should align with what’s typical in your industry and should clearly benefit your business operations. Most office and supply expenses meet these criteria and are fully deductible. However, costs that are overly extravagant, unrelated to business, or personal in nature don’t qualify. For example, business gifts are capped at $25 per recipient annually, so exceeding that limit won’t be deductible.

Documentation Requirements

Proper documentation is essential. Keep receipts, canceled checks, or bills that detail the amount, date, location, and purpose of the expense. The IRS stresses the importance of keeping records "timely", which means recording the details as close as possible to when the expense occurs.

Common Corporate Policies

Many companies align their reimbursement policies with the IRS's accountable plan rules. These rules require employees to report their expenses within a reasonable timeframe and return any excess reimbursement. Although the IRS only mandates receipts for expenses over $75, many employers have stricter policies, requiring receipts for all expenses. To ensure full deductibility, it’s critical to distinguish between shipping costs for business-related items (like samples or displays) and personal baggage. Additionally, supplies must be strictly for business purposes.

How to write off your travel expenses as a business...

Tips for Accurate Expense Categorization

Getting your expense categories right is more than just keeping things tidy - it’s crucial for maintaining your company’s tax-free reimbursement status and ensuring smooth financial operations. According to the IRS, expenses must meet the "ordinary and necessary" standard, meaning they should be common in your industry and genuinely needed for your business. Missteps in categorization can lead to noncompliance, which no business wants to deal with. Proper categorization forms the backbone of the efficient processes we’ve discussed earlier.

Take photos of receipts immediately.

Snap a photo of your receipts as soon as you make a purchase. This simple habit helps prevent lost records and keeps everything up to date. The IRS requires receipts for all lodging expenses, regardless of the amount, while expenses under $75 can sometimes be documented with detailed records instead. Staying on top of this ensures your expenses are ready for timely reporting.

Submit expense reports within 60 days.

The IRS considers 60 days a "reasonable period" for submitting expense reports under accountable plan rules. Missing this window could mean reimbursements are treated as taxable income. Lindsey Revill of Expensify warns, "One missing receipt or late expense report can unravel your entire tax-free reimbursement structure". Don’t let delays jeopardize your compliance.

Keep personal and business expenses separate.

Mixing personal purchases - like souvenirs or entertainment - with business expenses is a recipe for trouble. It can raise audit concerns and slow down reimbursements. Using a corporate credit card is a simple way to keep personal and business transactions clearly divided.

Use automated tools to stay compliant.

Platforms like EasyTripExpenses make expense tracking easier by letting you upload receipts, categorize expenses based on your company’s policies, and generate polished reports in PDF or Excel formats. Automating this process not only saves time but also reduces errors. Research shows that about 20% of traditional expense reports contain mistakes, and each error takes an average of 18 minutes to fix. With automated categorization and secure storage, you can ensure every expense is documented accurately and ready for audits. It’s one less thing to worry about in your financial workflow.

Conclusion

Accurate expense categorization is essential for protecting your finances and staying compliant with IRS regulations. The seven categories outlined earlier serve as the backbone for creating compliant business travel reports. By consistently tracking expenses, you not only establish a reliable audit trail but also speed up reimbursements and make smarter budgeting decisions. Applying these categories ensures your reports are both audit-ready and strategically useful.

Business travel often represents one of the largest controllable expenses for small and medium-sized businesses. In fact, the average U.S. business trip in 2023 cost around $1,293. Proper documentation is key to avoiding IRS penalties and ensuring that tax-free reimbursements don’t inadvertently become taxable income. As Kiersten Conner from SAP Concur explains:

"The healthier the financial processes, the better the oversight, the stronger the compliance, and the fewer inefficiencies that weigh the organization down".

Automated tools make the process even simpler. For example, EasyTripExpenses eliminates the headaches associated with manual expense reporting. With features like receipt uploads, automatic categorization based on the seven key categories, and the ability to generate PDF or Excel reports in minutes, it’s designed to save time and reduce errors. Secure data storage and built-in currency conversion mean you can focus on your trip without worrying about misplaced receipts or tedious calculations. Whether handling a single trip or managing dozens, a streamlined system ensures every dollar is accounted for and every report meets compliance standards.

Say goodbye to manual delays. Automated tools transform expense management into a fast, transparent, and hassle-free process.

FAQs

What steps should I take to ensure my business travel expenses are tax-deductible under IRS guidelines?

When it comes to making your business travel expenses tax-deductible, keeping thorough records is key. Hold on to receipts, travel itineraries, and notes that explain the business purpose behind each expense. For a trip to qualify, its primary focus must be business-related, and the costs should be considered both ordinary and necessary for your line of work.

It’s also important to understand specific IRS rules. For example, there’s a 50% deduction limit on meal expenses. Additionally, make sure you’re following the guidelines for lodging, transportation, and incidental costs. Staying organized and documenting expenses as they happen can simplify the process, ensuring you meet IRS requirements while making reporting easier.

What are the advantages of using tools like EasyTripExpenses for managing business travel expenses?

Managing business travel expenses becomes a breeze with automated tools like EasyTripExpenses. Gone are the days of sifting through stacks of receipts - these tools let you upload receipts digitally, automatically sort expenses into categories, and create polished reports in formats like PDF or Excel. The result? You save time, avoid errors, and stay in line with company policies.

Beyond convenience, automation speeds up reimbursements, improves compliance, and uncovers useful spending patterns. Features such as built-in currency conversion and secure cloud storage make EasyTripExpenses especially valuable for small teams and startups. It’s a straightforward way to stay organized and make smarter spending decisions, all without the headaches of old-school, paper-based systems.

What records do I need to keep for business travel expenses to meet IRS requirements?

To meet IRS requirements, you’ll need to maintain thorough records for every travel expense. This means holding onto an itemized receipt or other proof, such as a ticket, hotel invoice, mileage log, or canceled check. Additionally, you should include details like the business purpose, date, amount, and location for each expense.

Here’s what you’ll need for specific expenses:

- Transportation: Keep air or rail tickets and mileage logs if you’re using a personal vehicle.

- Lodging: Hold onto hotel bills that include itemized charges.

- Meals: Save itemized receipts that show exactly what was purchased.

- Incidentals: Document smaller expenses like tips or parking fees with receipts or a per-diem log.

It’s important to keep these records for at least three years to stay in line with IRS regulations.